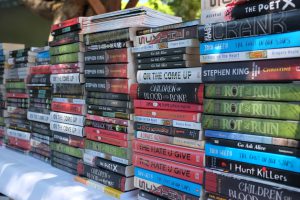

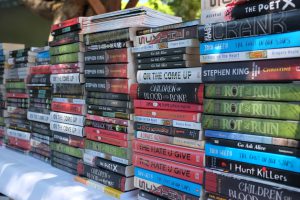

The Book Truck: Delivering Literacy in Southern California

Why Do Some People Read? For children in some communities, books and reading are omnipresent. Reading begins as amusement and entertainment and grows into a

Variable Definitions:

Banks: The number of bank locations in a given area

Credit Unions: The number of credit union locations in a given area

Methodology Note:

The original data comes at the point level. Our team geocoded the locations to generate X/Y coordinates, then spatial joined each point to 2020 Census Tracts.

Source:

Banks: Federal Deposit Insurance Corporation

Credit Unions: National Credit Union Administration

Years Available:

2019, 2020, 2021

Traditional banking services have historically provided the basic financial building blocks for individuals and families to gain economic stability. Residents without access to banking services often do not have a savings account to save for their future. They are unable to access affordable credit to purchase a home, pay for higher education, or replace an older vehicle. Further, when residents lack access to banking services they often turn to payday loans, check-cashing services, auto title loans, and other non-traditional forms of credit that charge high-interest rates and expensive fees, trapping consumers in a dangerous cycle of debt.

Communities of color have historically been excluded from financial services through a practice of financial exclusion known as redlining, which describes the practice of grading neighborhoods based on their credit risk by the Home Owners Loan Corporation (HOLC). In the 20th century, in order to support the issuance of new homeownership loans, the HOLC created a series of maps that ranked neighborhoods by risk. Wealthy, predominately white neighborhoods were outlined in green, reflecting low risk neighborhoods. Low-income communities of color such as Boyle Heights and Central-Alameda in East and South Los Angeles were outlined in red, reflecting high risk neighborhoods. Redlining quickly became known later as “de facto” segregation and prevented these communities from accessing credit and formal financial institutions. While redlining was outlawed in 1968 by the Fair Housing Act, the effects of this discriminatory practice lasted generations and continues to impact the financial stability of many low-income communities across the nation.

Banks

This dataset includes banks that are insured by the Federal Deposit Insurance Corporation (FDIC). The number of banks in a neighborhood is a useful measure of residents’ access to mainstream financial services like checking and savings accounts, small business credits, and mortgages. Since the financial crisis in 2009, almost 5,000 bank branches have closed in the U.S., creating what some researchers are calling “banking deserts.” A banking desert is a census tract that has no bank branch within ten miles of the center of the census tract. This can be especially problematic for elderly and low-income residents without access to reliable transportation and can leave such communities vulnerable to predatory high cost lenders offering payday and vehicle title loans.

Credit Unions

This dataset includes credit unions that are insured by the National Credit Union Administration (NCUA). Credit unions can serve as key resources for community development through small loans that traditional banks are often unwilling to give. Credit unions differ from traditional banks in their not-for-profit, member-owned structure. They are governed in a democratic style with a volunteer board of directors and usually place a large emphasis on local community relationships. Because of their not-for-profit structure, credit unions are often able to make small loans to low-income consumers at competitive rates that for-profit banks would be unwilling to give. As a result, they can serve as a key component of the development of local business and infrastructure in low-income communities.

See also: High Cost Lenders

Citation:

Morgan, Donald et al. “How do bank branch closures affect low-income communities?” World Economic Forum, 7 March 2016. Link

Tansey, Charles D. “Community Development Credit Unions: An Emerging Player In Low Income Communities.” The Brookings Institution, 1 September 2001. Link

Reft, Ryan. “Segregation in the City of Angels: A 1939 Map of Housing Inequality in L.A.” KCET, KCET, 14 Sept. 2017, www.kcet.org/shows/lost-la/segregation-in-the-city-of-angels-a-1939-map-of-housing-inequality-in-la#_ftnref14.

Why Do Some People Read? For children in some communities, books and reading are omnipresent. Reading begins as amusement and entertainment and grows into a

Learn More Metadata Download the Dataset View on Map Variable Definitions:Museums: The number of museums in a given area Source:Google Maps API Due to the

Learn More Metadata Download the Dataset View on Map Variable Definitions:Total Active Businesses: The number of businesses that are registered with the LA Office of