Home Affordability in the USC Area

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

Variable Definitions:

Mortgage Approval Count: The total number of mortgage applications that are approved in a given area, as reported by the Home Mortgage Disclosure Act (HMDA) Loan/Application Register

Mortgage Denial Rate: The percentage of mortgage applications that are denied in a given area, as reported by the Home Mortgage Disclosure Act (HMDA) Loan/Application Register

Source:

Federal Financial Institutions Examination Council

Years Available:

2011- 2023

Mortgages are an agreement between a homeowner and a financial institution allowing individuals to borrow money to purchase a residential property. Homeownership remains an important path to wealth-building and stability for millions of households even after the Great Recession (Harvard Joint Center for Housing Studies).

The Home Mortgage Disclosure Act, enacted by Congress in 1975, aims to determine whether financial institutions are serving the housing needs of communities and identify possible discriminatory lending patterns. Following the 2008 financial crisis, more borrowers could not afford their mortgages, and many lenders stopped lending. Subprime mortgages and predatory lending ultimately lead to many Black and Brown homeowners being forced to foreclose. Prior policies, such as the Fair Housing Act, passed in 1968, prohibited discrimination in mortgage lending based on race, color, religion, sex, disability, familial status, or national origin. The HMDA, however, requires certain financial institutions to publicly provide mortgage data.

Denial rates are different among racial groups. Historically, mortgage application and loan denial rates have been significantly higher for black and brown communities. According to Home Mortgage Disclosure Act data, of all mortgage applications submitted in 2020, Black borrowers had the highest denial rate of 27.1%, and white borrowers had the lowest denial rate of 13.6%.

Calculating denial rates can be a valuable tool for researchers to understand solutions to improving homeownership, making housing more affordable, and understanding the housing crisis. Furthermore, government programs and policies shape homebuyer markets and the housing finance system, so understanding denial rates can be helpful for legislators and policymakers.

Written by Rediet Retta

Citations:

Agency, C. H. F. (n.d.). Building Black Wealth. Www.calhfa.ca.gov. https://www.calhfa.ca.gov/community/buildingblackwealth.htm

Choi, J. H., & Mattingly, P. J. (2022, January 13). What Different Denial Rates Can Tell Us About Racial Disparities in the Mortgage Market. Urban Institute. https://www.urban.org/urban-wire/what-different-denial-rates-can-tell-us-about-racial-disparities-mortgage-market

Fair Lending | HUD.gov / U.S. Department of Housing and Urban Development (HUD). (n.d.). Www.hud.gov. https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_lending

FFIEC Home Mortgage Disclosure Act. (2011). Ffiec.gov. https://www.ffiec.gov/HMDA/

Goodman, L., & Seidman, E. (2019, May 21). Curtailing Data from the Home Mortgage Disclosure Act Is a Mistake | Urban Institute. Www.urban.org. https://www.urban.org/urban-wire/curtailing-data-home-mortgage-disclosure-act-mistake

Helping Low-Income, First-Time Homebuyers – LAHD. (n.d.). https://housing.lacity.org/housing/helping-low-income-first-time-homebuyers

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

According to the Economic Policy Institute (EPI), 8.4 million jobs have been lost since the start of the pandemic in February 2020, and over 5 million people

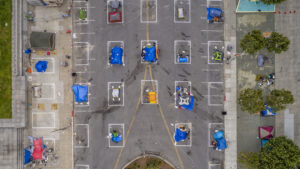

Across the nation, the population experiencing homelessness is getting older. The end of the Baby Boomer generation (those born between 1955 and 1964) have faced