Home Affordability in the USC Area

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

Variable Definitions:

Homeownership Rate: The percentage of housing units occupied by the owner of the unit

Renter Rate: The percentage of housing units who are occupied by someone who is not the owner of the unit

Source:

American Community Survey (ACS), 5-year estimates, Table B25003

Years Available:

2010 – 2023

*Note: Each year of available data shown above is a 5-year estimate, or an average of data collected over a five year period. 5-year estimates are used to increase the reliability of the data at small geographies like neighborhoods and census tracts. The years shown on the NDSC map represent the final year of the five year average (e.g. “2010” represents 2006-2010 data, “2011” represents 2007-2011 data, and so on). For the most impactful comparison of data over time, the ACS recommends comparing non-overlapping years (e.g. 2010-14 with 2015-19).

Homeownership Rate

Owning a home has long been considered an important milestone, as it represents a step toward long-term financial stability. It offers benefits to the neighborhood, as well: homeowners move less frequently and tend to be engaged in their community and its institutions, such as schools and businesses. Because they are financially and personally invested in the neighborhood, homeowners often take interest in local improvement initiatives.

Written by Priya Ranganath

Citation:

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

According to the Economic Policy Institute (EPI), 8.4 million jobs have been lost since the start of the pandemic in February 2020, and over 5 million people

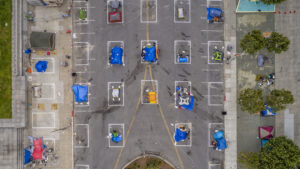

Across the nation, the population experiencing homelessness is getting older. The end of the Baby Boomer generation (those born between 1955 and 1964) have faced