Home Affordability in the USC Area

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

Variable Definitions:

Commercial Address Share: The percentage of mailing addresses that are used for business purposes, such as retail spaces, office buildings, warehouses and industrial sites

Residential Address Share: The percentage of mailing addresses that are used for living purposes for individuals and/or families

Note: The USPS defines addresses as either residential, commercial, or other. The “other” classification includes places that are neither residential nor commercial, such as educational institutions or government facilities.

Commercial “No One Home” Properties: The number of commercial properties that have not collected their mail for 6 months or longer

Residential “No One Home” Properties: The number of residential properties that are have not collected their mail for 6 months or longer

Source:

U.S. Department of Housing and Urban Development (HUD) Aggregated United States Postal Service (USPS) Administrative Data on Vacant Properties

Years Available:

2012 – 2024

Commercial Share

Areas with a high Commercial Address Share tend to have more businesses, offices, and industrial sites than homes and apartments. These commercial-heavy neighborhoods have different infrastructure needs, such as transportation access for customers and employees, as well as different zoning and land use regulations. Historically, some communities in LA County have seen environmental burdens like polluting factories sited in their neighborhoods because of less restrictive zoning. Knowing the Address Type can help policymakers and advocates identify commercial-heavy areas and work to balance community needs. For example, initiatives could aim to limit the over-concentration of commercial uses while also encouraging equitable economic development.

Residential Share

The Residential Address Share variable specifically provides insight into the housing makeup of a neighborhood. A high Residential Address Share indicates an area with predominantly residential addresses such as single-family homes, apartments, and condos. For policymakers, a high residential concentration highlights neighborhoods in need of resources like parks, schools, housing code enforcement, and services for families and children. It also indicates areas with a significant housing stock that play a key role in regional housing availability and affordability. Understanding where residential addresses are concentrated helps policymakers assess housing needs, target services and amenities, and evaluate the impacts of new housing policies across LA County’s diverse communities. For residents, this data empowers community groups to advocate for neighborhood improvements in highly residential areas and collaborate to shape an equitable vision for their community’s future. Overall, the Address Type sheds light on the diverse patchwork of neighborhoods across LA County. With these data insights, local leaders and community members can tailor policies, services, and resources to fit the unique residential and commercial contexts of their communities.

“No One Home” Properties

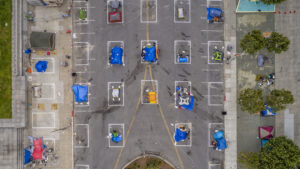

Under an agreement between United States Postal Service (USPS) and the U.S. Department of Housing and Urban Development (HUD), USPS shares quarterly data on addresses identified as not collecting their mail for 6 months or or longer. Hyper-vacancy is described as neighborhoods in which 20 percent or more of the buildings and lots are vacant. Vacant properties are often concentrated in areas that are experiencing losses in jobs, investment and economic opportunities. Further, vacant or abandoned properties are costly to cities as a result of decreased tax revenue and increased crime and maintenance costs. Vacant properties also contribute to general blight which has a negative effect on property values. A Philadelphia study found that vacant properties reduced household wealth due to blight by an aggregate $3.6 billion. Vacancy is useful for researchers and practitioners exploring population growth, development patterns, rent evictions or gentrification trends.

Written by Debarun Sarbabidya

Citation:

Boone, C.G., & Modarres, A. (1999). Creating a Toxic Neighborhood in Los Angeles County. Urban Affairs Review, 35, 163 – 187.

Boer, T.J., Pastor, M., Sadd, J.L., & Snyder, L.D. (1997). Is There Environmental Racism? The Demographics of Hazardous Waste in Los Angeles County.

Howard, Pat. (2018). “Vacant and unoccupied homeowners insurance”. Policy Genius. Link.

Krumholz, N. (1999). Equitable Approaches to Local Economic Development. Policy Studies Journal, 27, 83-95.

Mallach, Alan. (2018). “The Empty House Next Door”. Lincoln Institute of Land Policy. Link.

Philadelphia Redevelopment Authority and Philadelphia Association of Community Development Corporations. (2010). Vacant land management in Philadelphia: the cost of the current system and need for reform. Link.

Sisson, Patrick. (2019). Blight and vacant land are a national crisis for smaller cities. Curbed. Link.

Turner, A., & Gourevitch, R. (2017). How Neighborhoods Affect the Social and Economic Mobility of Their Residents.

United States Department of Housing and Urban Development. “HUD aggregate USPS administrative data on address vacancies”. Link.

In 2006, when USC began planning its new mixed-use “Village” development, the UNIDAD Coalition ––a group of community-based organizations in South Central–– arose to ensure

According to the Economic Policy Institute (EPI), 8.4 million jobs have been lost since the start of the pandemic in February 2020, and over 5 million people

Across the nation, the population experiencing homelessness is getting older. The end of the Baby Boomer generation (those born between 1955 and 1964) have faced